|

Published by The Pacific Business Hub | By Cecilia Sagote of Seki Media When Ama Hemana, 26, started university years ago, she wanted to get into law, then politics, then journalism. She finally settled on studying business.

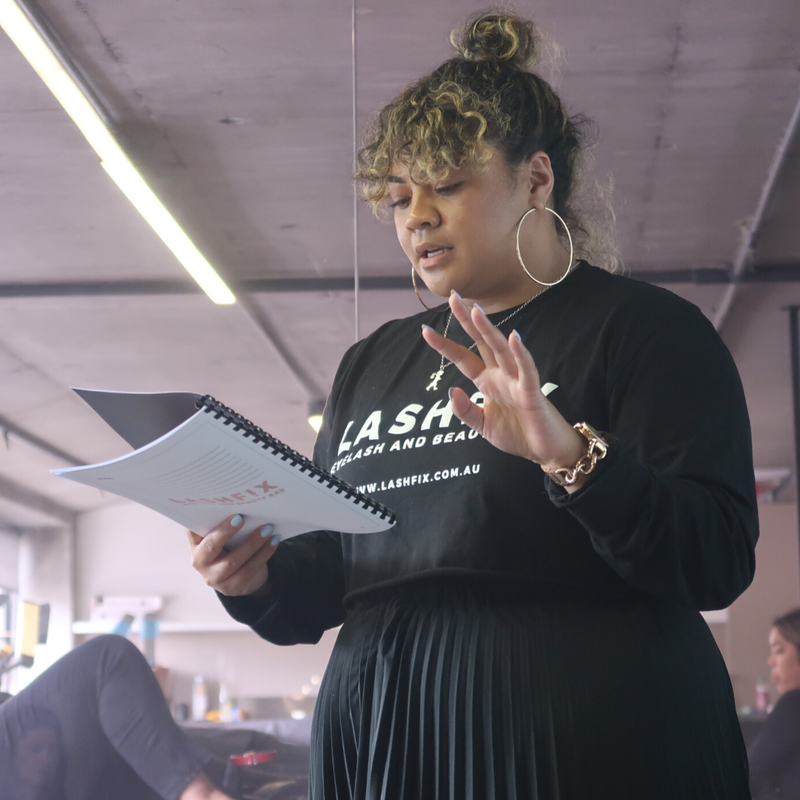

When she studied her first marketing paper, she was intrigued. “I was blown away by how much information was immediately applicable to anything,” she says. At the time, her sister Venna had started her own beauty business LashFix, the perfect ‘guinea pig’ for Ama to put her marketing theory into practice. Six years later, Ama’s marketing style has been credited as a big factor in LashFix’s success in Australia. “People often ask me ‘who does the marketing for LashFix?’” she laughs. “My sister and I are both in a place in our business where we are happy and growing considerably and now we are both teaching our own ‘trades’. So it was natural for me to offer marketing as a service.” Ama has named her brand, ‘Ama Zin’ Marketing, a play on her own name - one that she believes her business can live up to. Before Covid-19 hit Melbourne, Ama had started teaching her sold out workshops in Auckland and Melbourne. “I was so nervous,” she laughs. “My first workshop in Auckland was face to face and I was sweating like crazy. I kept shaking and stuttering and then I did the same during my first online workshop!” “It's a scary feeling to say you're good at something and to try and stand out especially as a Polynesian woman. We're taught to be humble and quiet but when you're running a business and need to get clients, you can't do that staying quiet.” She adds that a little prayer before her workshop does wonders. As well as stepping out of her comfort zone with a ‘just do it’ attitude. “The feedback has been amazing so far, especially around the topic of clarity and how one can operate as a business on their own terms. “My workshop is based on marketing your business as a reflection of who YOU are as an individual not what you think your business is supposed to be like. If you have a look at LashFix we are not and have never been your typical beauty bar and that’s what has helped us stand out from our competitors.” She is using this Covid lockdown time to co-ordinate more mentoring workshops for small businesses as well as improving on her popular video “lives” on social media which her followers tune into - something she continues to try and master confidence in. When asked to offer advice to other start-ups, Ama hones in on some common errors she notices other businesses do. “A lot of businesses are posting on social media just to post or just to grow their follower count, which can be helpful for business but without a strategy or lack of direction and it's ineffective. We're too busy worrying about popularity instead of converting our follower count into dollars.” You can book into the amazing Ama Zin Workshop here: https://lashfix.com.au/products/ama-zin-marketing-workshop?variant=32148716126257

3 Comments

Published by The Pacific Business Hub | By Cecilia Sagote of Seki Media George Tofa of Melbourne understands first hand how Pacific culture can play a significant part in families finances.

The 33-year-old Samoan whose parents are from Saipipi, Savai’i and Vailuutai has been running his Liberty broker business for four years and has a growing portfolio of diverse clients. As he services people’s financial needs as well getting them into their first homes, the certified finance and mortgage broker has one rule of thumb when building his Pasifika clientele in particular. “I want people to feel empowered and to ‘go against the grain,’” he says. “A lot of our people think working in a comfortable job or becoming a footy player are our only options which is great but I also encourage them to look beyond the status quo because I know a lot of ‘over qualified’ people in their respective industries but are comfortable where they are.” He is a big believer that Pacific families will benefit greatly if financial literacy is taught in the home especially from an early age. “Finances are not always talked about openly in some families and not everyone gets a say." “When I was growing up, the usual family meeting was called and we discussed things like fa'alavelave. But a common old school mentality is this hierarchy. For example, the dad says something and everyone else listens rather than going around the table.” He says democracy in family decision-making is key. “I want the new generation to have a different approach. Start conversations with mum and dad and openly talk about money. Yes we have the standard emergencies from Samoa and there’s nothing we can do about it, but it doesn’t have to be a negative thing. We can still make good decisions on the amounts we give, set goals and work around these.” Surprisingly Covid-19 has been a blessing in disguise financially for some Pacific families in Australia who have managed to access superannuation funds and spend more time with their families, however George admits he is missing the human interaction with clients. “Building rapport in person is easier than building rapport over the phone or on zoom,” he laughs. But for the father of two, it’s an opportunity for him to manage work and family life even better. He outsources marketing tasks to a specialist so that his social media posts are frequent, informative and relevant. Like any other business, his first year of operation came with it’s challenges such as building partnerships and a network of referral partners - trying to obtain business from them as well as from his own clients. Four years on and he has established himself as the ‘go-to’ Pacific broker in Melbourne’s West and continues to sign on delighted clients and even sponsor local Pacific events. His easy-going personality and a genuine interest in helping people better their situation plays a big part in his business going from strength to strength. “I help people who are knocked back from their banks and as a broker I am able to offer them a whole lot more options and a personalised approach.” Contact George to discuss your financial needs: Melbourne: 0432 725 244 Website: liberty.com.au/george-tofa Published by The Pacific Business Hub | By Cecilia Sagote of Seki Media Owning a steady business is one thing. But to maintain a business and to constantly be innovative is another.

That’s what Melbourne-based Pasifika business LASHFIX have been working on in the last year as they closed up their brick and mortar salon in the trendy suburb of Port Melbourne to focus on a ‘giving back’ method to build their brand. And it’s a move that is working for them. For six years, sisters Venna, 33 and Ama, 26 operated their popular beauty business which saw a stream of diverse clients coming in and out, from social media influencers to international female sports stars. The trials and errors they experienced in running their shop have been valuable for the duo’s business growth. “Running our beauty salon definitely took up a lot of time and energy,” says Venna. “It wasn’t easy but we learnt so much. Like what it means to have a budget and work within it. It’s crazy thinking back to how we were able to pay wages every week, pay $7000 a month to rent and keep the lights on plus tax. We learnt so much about ourselves but it wasn’t always rainbows and fairies. We were stretched so thin.” They remind other entrepreneurs that doing what you love doesn’t mean it should drain you to the point that you are compromising other important areas. “It is crucial you are looking after your mental and physical health. If you are constantly running on passion alone and not nurturing the other parts of your body and your life, you will feel drained. This is something we learnt the hard way.” Now with Covid-19 taking over Melbourne and putting enormous dents in small businesses everywhere, the girls say that the pandemic has instead given them time to reflect on their business goals. “To be honest, Covid came at the perfect time for us. We were just about to renew our lease but because we were forced to close down in March, we had time to be with our family and just enjoy being in their presence. It gave us the time we needed to re-centre, refocus and shift our perspective on what we value.” And part of that re-focus is working on a new dimension of their LASHFIX brand: Teaching. Last year Lashfix had orchestrated training workshops in Auckland and Melbourne leading up to the closure of their salon. The girls are grateful that they have managed to run a few training workshops in Melbourne as their sole focus for business just before Covid hit. “We have always wanted to offer lash training. A lot of the high school clients here in Melbourne are NZ citizens which meant that they’re not eligible for student loans or government assistance.” “I remembered them saying things like, ‘I wish I was able to do this or that.’ They felt like their only option was factory work which isn't a bad thing. Our parents worked in factories so we are not bagging factory work. We just want to create a different pathway for young Pasifika women.” And with valuable lash experience under their belts, they are able to command $2000 - $5000 per person for their courses. Lashfix also offer the Afterpay option so that students can pay in instalments and alleviate any debt. “The most common feedback we get from our training courses, is that we are warm and inviting. The space we have created is open, safe and comfortable. “A lot of the time, our students are surprised at how much there is to learn about lashes and the business side. We've even had girls come to us after training elsewhere looking for more intense training.” Book your lashfix course and start your career in beauty! www.lashfix.com.au |

AuthorThe Pacific Business Hub Archives

July 2022

Categories |

RSS Feed

RSS Feed